Share this

Who’s Really Winning the Streaming Wars: DNS Traffic, Earnings, And More

by Serena Raymond on Jun 3, 2021 12:00:00 AM

“Not every streaming service deserves to exist or win,” Kevin Mayer, former head of Disney+ and ex-CEO of TikTok, told CNBC. What Netflix started has become an all-out war, with every media company in the world fighting for subscribers.

Netflix has had a long reign when it comes to being the top streaming giant. But with the blockbuster success of Disney+ and the oversaturation of the streaming market, that position isn’t as secure anymore.

We’re curious about where the streaming market is going and what all of this means for DNS traffic. We decided to compare 12 months of network data for the following streaming platforms:

- Amazon Video

- Disney+

- HBO

- Hulu

- Netflix

We’re specifically interested in pay-for-play streaming media. So while daily visits to YouTube make up 55% of streaming traffic on DNSFilter in a day, we won’t be examining that today. Instead, what we’re looking at is a combined 41% of our daily streaming traffic.

It should be noted that DNSFilter is primarily a service that is used by businesses to block threats and certain websites from employee access. But employees still use their work devices to access streaming media—and we can’t say for certain whether it’s on or off the clock. Because of this, streaming makes up just a fraction of our network but we still get as many as 30 million queries to streaming sites every day.

Let’s consider the finances

Before we get into the DNS data, we should understand where each of these platforms stand when crunching the fiscal numbers.

First, let’s consider the number of users each platform has as of early 2021.

| Platform | Number of subscribers |

|---|---|

| Netflix |

|

| Amazon Video |

|

| Disney+ |

|

| HBO |

|

| Hulu |

|

The following is from an article published in April 2021 on Variety:

“HBO Max isn’t turning in the kind of eye-popping subscriber growth that Disney Plus, which now tops 100 million worldwide users, has reported. But AT&T noted that domestic HBO Max and HBO revenue per subscriber for Q1 was $11.72 per month, down 2% from $11.97 for HBO in Q1 2020. By comparison, Disney Plus reported ARPU [Annual Revenue Per User] of $4.03 per month for the year-end 2020 quarter (down 28%). Meanwhile, Netflix reported Q1 ARPU of $14.25 for its U.S./Canada region (up 9%).”

Hulu, meanwhile, was bringing in $13.51 per use in Q1 of 2021, but projected Q2 numbers have taken a big dip and are now down to $12.08.

Despite the large number of subscribers, the financials on Disney+’s ARPU look weak in comparison to its competitors. Their current numbers actually place their profits below Hulu, the platform with the lowest number of subscribers.

Netflix Vs. the world

When we look at the network traffic of these five streaming platforms, Netflix is the clear frontrunner when it comes to:

- Average daily DNS queries

- The highest number of DNS queries in a single day in the last 12 months

- The highest number of blocked daily DNS queries on our network

The share of total traffic to these platforms looks like this:

| Percent of average daily traffic | |

|---|---|

| Netflix |

|

| Amazon Video |

|

| Hulu |

|

| HBO |

|

| Disney+ |

|

While Netflix and Amazon follow the financials, Hulu is beating out competitors who have more subscribers when it comes to app usage. And surprisingly, the No. 3 streaming platform (and the one with the most momentum) doesn’t have a lot of traffic on our network at all.

As mentioned above, we are primarily a service used by businesses and it’s possible that a family-friendly streaming service like Disney+ just isn’t as heavily used on work devices.

However, when we examine the highest number of daily DNS queries per platform (think the best day of the entire year), Disney+ outstrips HBO by roughly 70,000 DNS queries.

When Disney+ was popular on our network, it was very popular. But when HBO was popular, it wasn’t too much higher than its average.

But streaming services are something that a lot of companies want to block. When we look at our streaming category as a whole, about 5% of all attempted DNS traffic to streaming sites is blocked.

| Percent of Blocked DNS Queries on each platform | |

|---|---|

| Disney+ |

|

| Hulu |

|

| Netflix |

|

| Amazon Video |

|

| HBO |

|

When we compare the percent of traffic to a certain domain that is blocked by DNSFilter, the numbers are entirely different.

Perhaps because of the popularity of Disney+ over the last year, we block a higher percentage of Disney+ queries than any of the other streaming platforms despite it being the platform that has the fewest queries on our network.

What’s most interesting about this table is that Netflix sits squarely in the middle. As the platform that statistically on our network a person is most likely to go to for streaming media (again, not counting YouTube!), it's interesting that it isn’t blocked by administrative policies more often.

This might be a case of trust, or perhaps not wanting to block employees from accessing streaming media they use after work hours.

What drew the crowds?

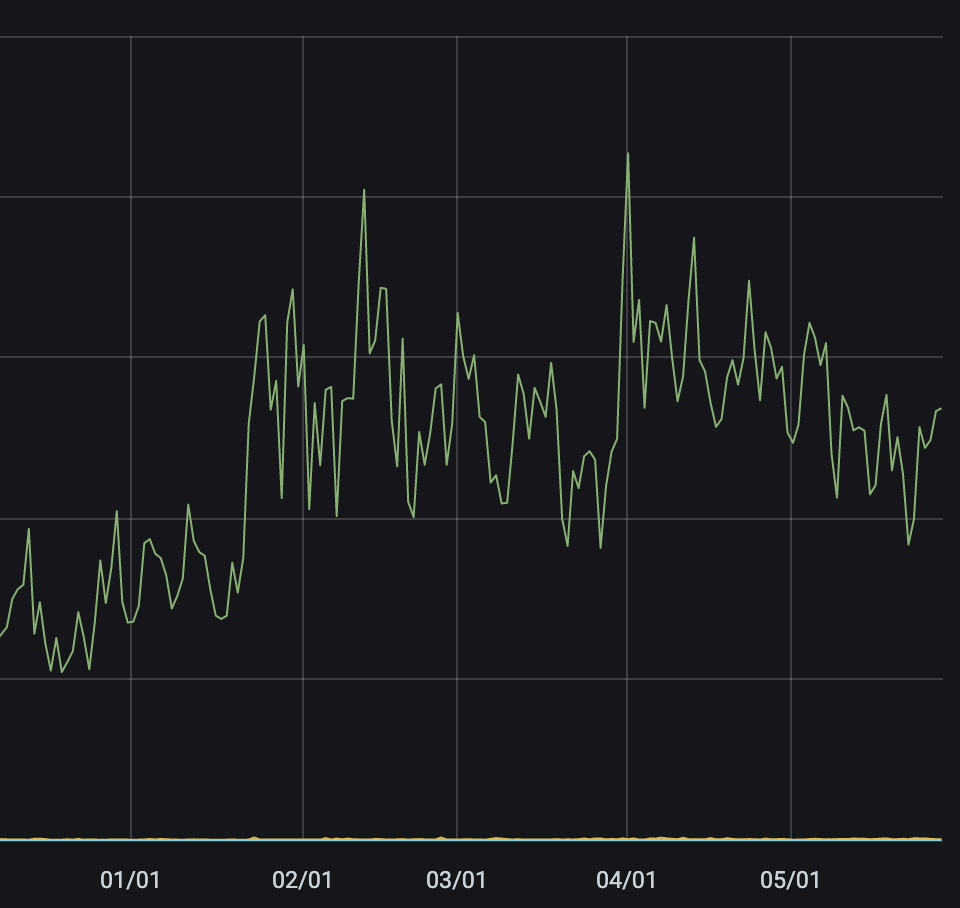

HBO’s partnership with WarnerMedia this year gave a significant boost to the platform. They saw nearly 3 million new subscribers early in 2021. When we look at the DNS data we can see that our users were tuning in as soon as those movies hit the streaming service.

Wonder Woman premiered on the platform on Christmas Day. Our network saw a slight bump on that date, but the real increases came in February and March as it was announced that more exclusive WarnerMedia content was coming to the platform. The infamous Snyder Cut of Justice League was released on March 18 and King Kong Vs. Godzilla premiered on March 31.

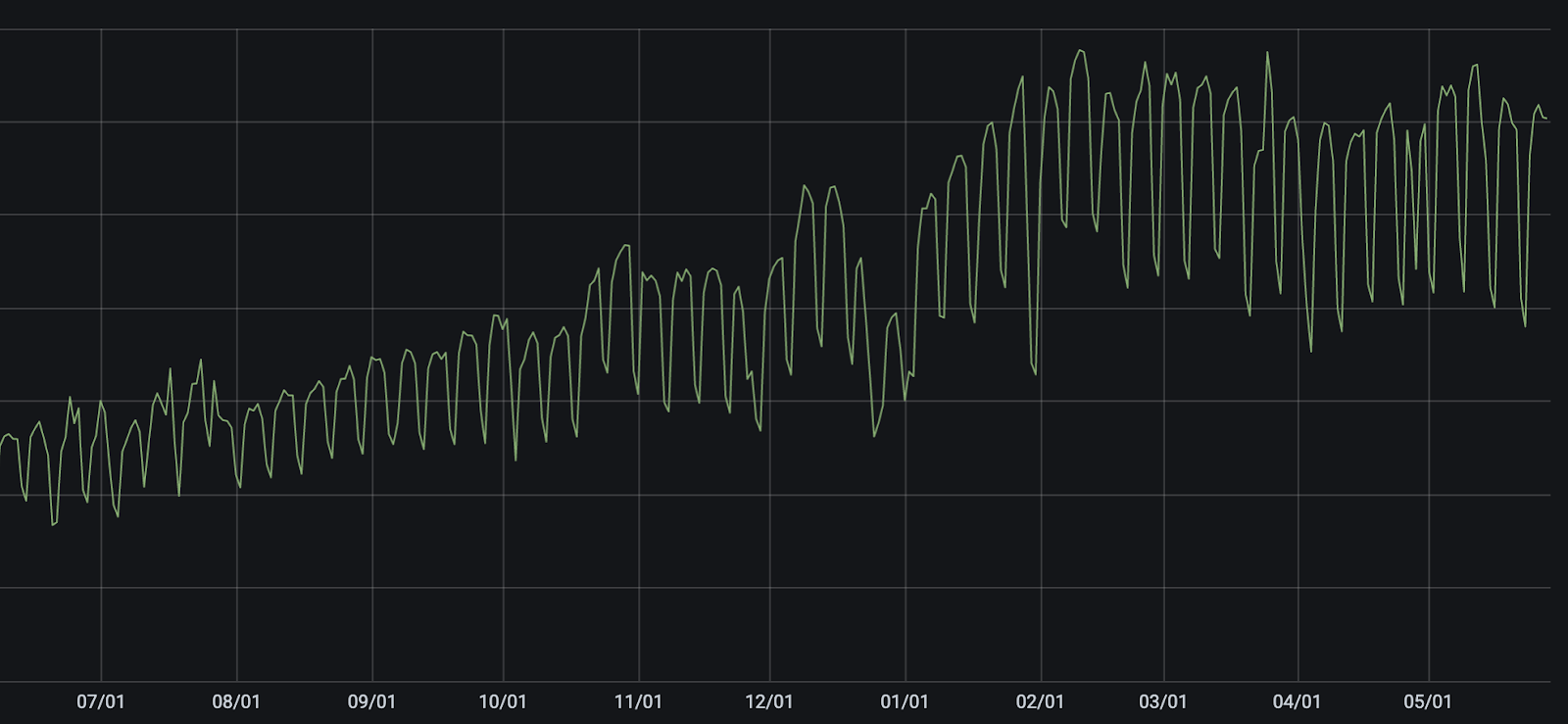

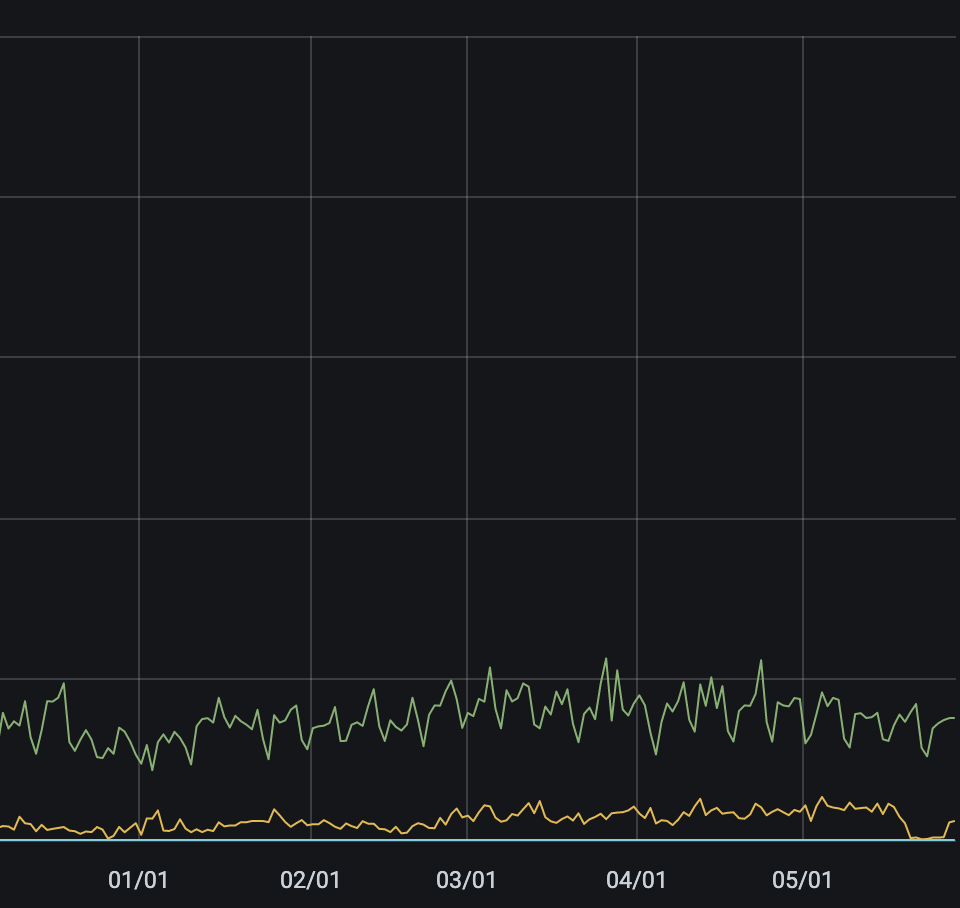

Looking at the same time period, Netflix has a very different trajectory despite its apparent position as top streaming platform.

On our network, we saw a steady increase in traffic through February before it fell off. Based on what was at Netflix at that time, it’s possible that users were catching up on Oscar-nominated movies. And Netflix had 17 nominated titles for viewers to choose from—a new record for them—including films that took home major awards like Ma Rainey’s Black Bottom, Mank, and My Octopus Teacher.

While viewers seemed eager for the Snyder Cut, there didn’t seem to be as much interest in Zack Snyder’s Army of the Dead, which premiered on Netflix on May 21.

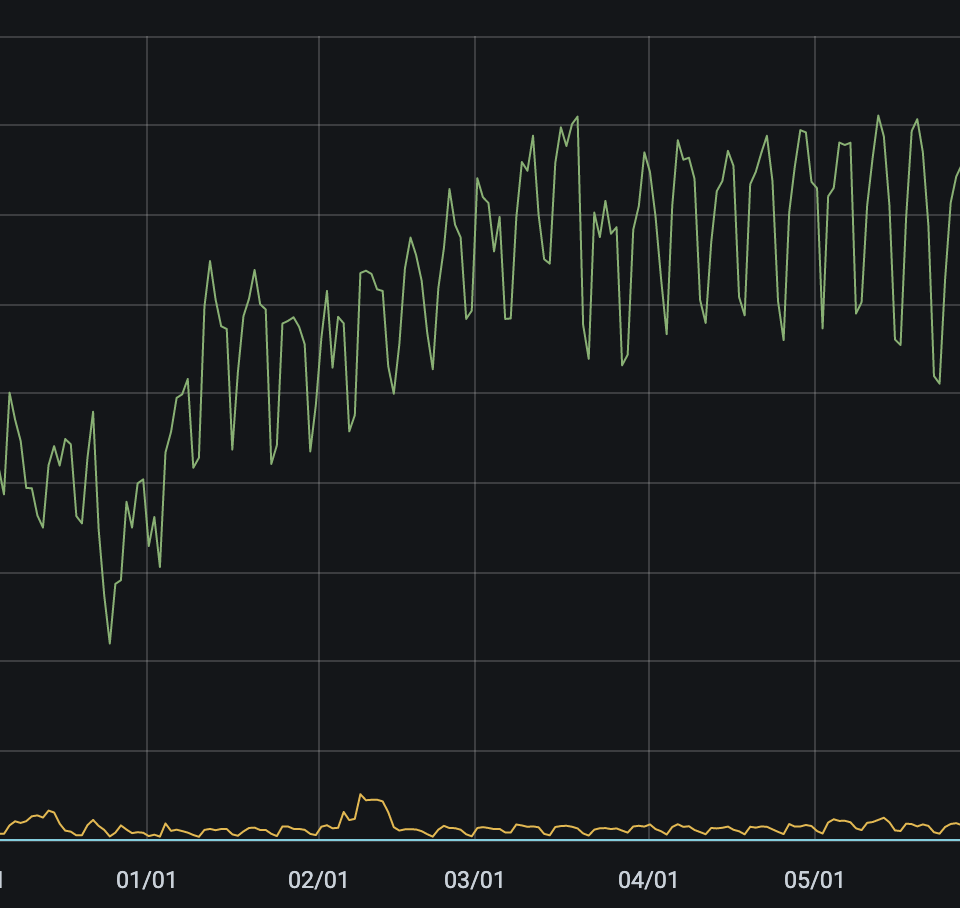

Hulu hasn’t had many peaks so far in 2021, but it’s been steadily increasing in the number of daily DNS queries.

It seems likely that Hulu’s average daily DNS queries in 2021 will be double what they were in 2020. However, Hulu’s traffic saw a slight dip around March 19 that’s been increasing slowly ever since. Coincidentally, the Bachelor’s finale aired on March 15, which those who bundled their Hulu subscription with the live TV option were able to watch.

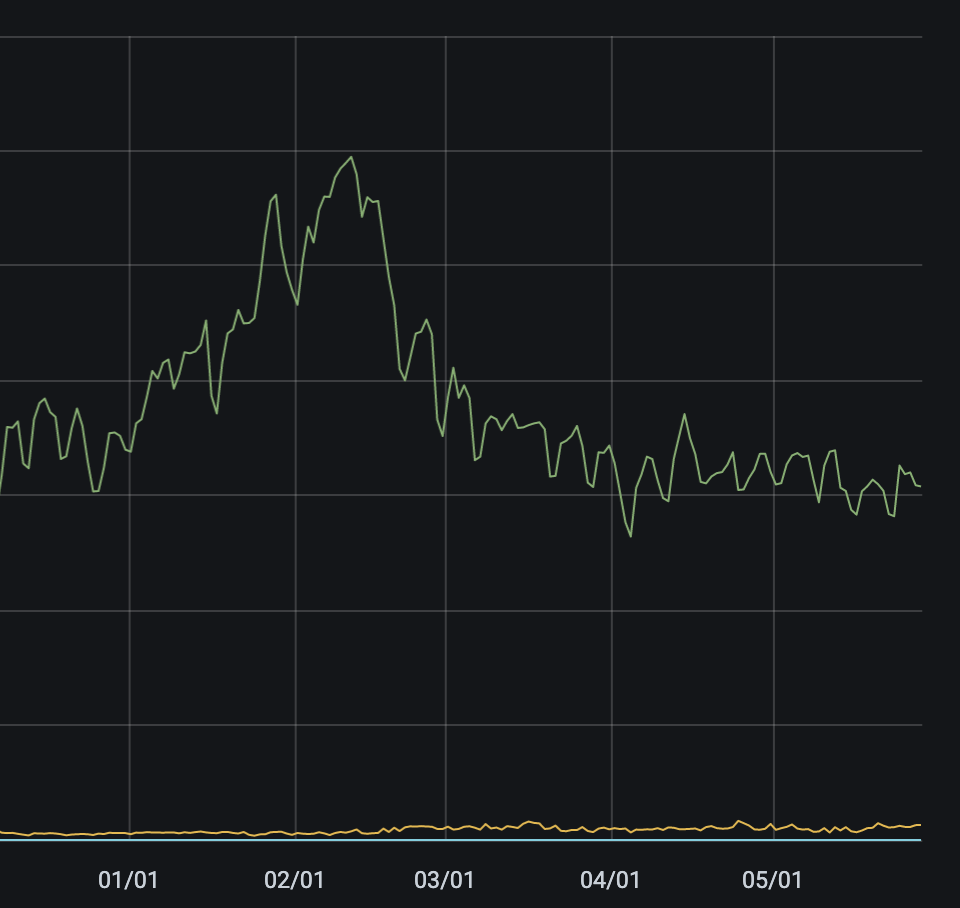

Amazon Video’s DNS traffic doesn’t tell us a story besides increased usage. There are no real spikes or dips except for around the last two weeks of the year in 2020. And what we see of Disney+ is very similar except there is no increase. Disney+ traffic on our network is stagnant.

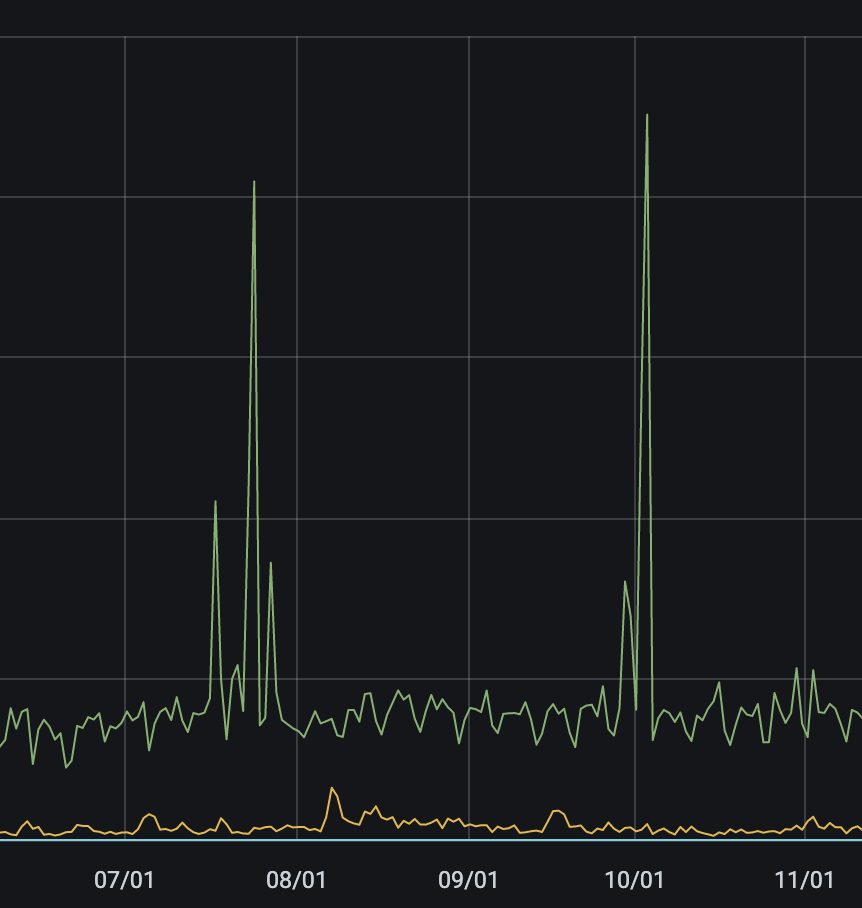

Since June 2020, traffic has hovered around the same range we see as of May 2021. But there are two spikes that occur on the Disney+ data that both happen in 2020:

On July 24 and October 3 of last year, Disney+ had their best days on our network. And then promptly went back to normal.

The live stage recording of Hamilton launched on Disney+ on July 3, and helped them drive new app downloads to the tune of 74% higher than the previous week.

But the cause for the spike on October 3 is a little harder to pinpoint. The Mandalorian wouldn’t premiere on the network until October 30—and traffic on our network did not react to that release. What was released early in October were mostly movies that had already been around for a few years. It’s unclear what this spike could have been which leads us to...

The caveats

If you read our blog on TikTok usage, you might know where this is going.

The platforms we’ve been comparing don’t use a single domain when you’re streaming your media. They will often use multiple domains, likely CDNs (content delivery networks), to create your streaming experience. And sometimes that means taking a single action (like watching a 22-minute sitcom) can send dozens or hundreds of DNS queries in that 22-minute timeframe.

Because of this, it’s possible that spikes and dips in traffic could be related to app changes as opposed to changes in viewers’ habits—or the airing of the season finale of the only good show on a streaming platform. So maybe it’s not that our users aren’t going to Disney+. Maybe instead, Disney+ is more efficient with the queries they send than the other platforms.

That’s something else to look into in the future.

Interested in more learnings from DNS traffic? Check out this presentation with our CEO Ken Carnesi where he identifies phishing and malware sites that have cropped up because of what’s happening in the news.

Share this

Artificial Intelligence in Cybersecurity

Artificial Intelligence in Cybersecurity

The term “artificial intelligence (AI)” was first coined in 1956. While progress stalled for many years, we can thank IBM for sparking real interest in AI as viable technology: First in 1997 when the computer Deep Blue defeated a chess champion and again in 2011 when Watson won Jeopardy!

The Mind Games Behind Cyber Attacks

The Mind Games Behind Cyber Attacks

Hackers have long understood that the most sophisticated firewall is no match for a well-placed psychological trick. While many focus on the technical prowess of cybercriminals, the real magic often lies in their ability to manipulate human behavior. By exploiting our natural tendencies and cognitive biases, hackers can slip past even the most robust security systems. It's not just about cracking codes; it's about cracking the human psyche.

AI and Cybersecurity Risks: Why DNS Filtering is Critical for AI-Driven Workplaces

AI and Cybersecurity Risks: Why DNS Filtering is Critical for AI-Driven Workplaces

Artificial intelligence is transforming business operations, automating everything from customer service to data analysis. But with these advancements come new security challenges. AI-driven cyber threats are becoming more sophisticated, enabling attackers to automate phishing campaigns, generate malware, and exfiltrate sensitive data at scale. Without proper safeguards, AI tools can unintentionally leak corporate secrets or connect to malicious ...